Niseko’s reputation as one of Asia’s leading alpine destinations has long been shaped by its visitors. Yet the profile of those visitors, when they arrive, and how they travel has changed meaningfully over time. For property buyers, these shifts are more important than headline visitor numbers.

Today’s Niseko market is defined less by volume and more by consistency, repeat visitation, and international diversity. Understanding who is visiting now, and why, helps explain rental performance, buyer demand, and which types of property continue to hold long-term appeal. As we move through 2026, the intersection of tourism trends and real estate investment has never been more critical for those looking to enter the market.

Winter Source Markets: The Economic Engine

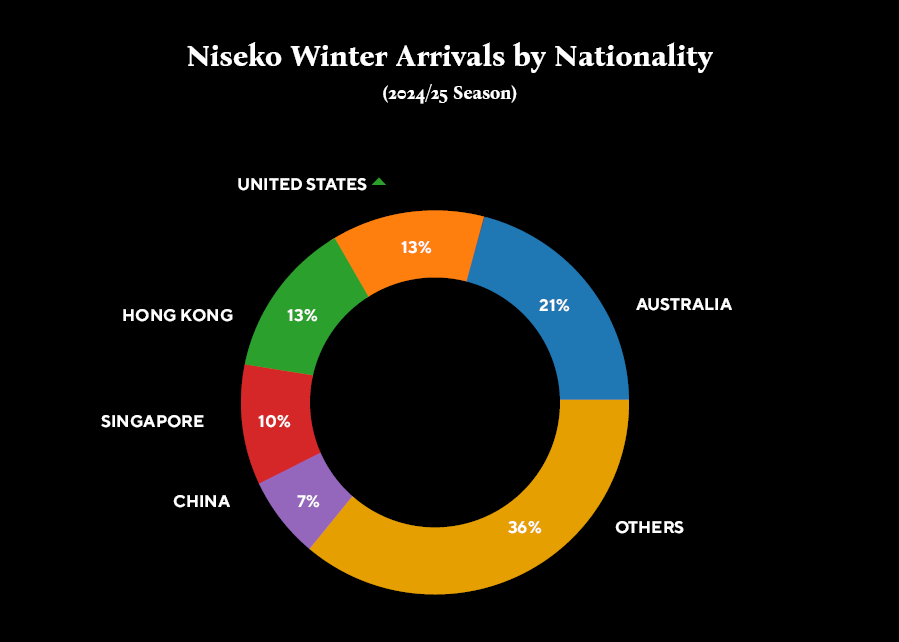

Winter remains the economic engine of Niseko, and the international mix behind it has become both broader and more resilient.

Australia: The Foundational Market

Australia continues to be the dominant winter market. Australian visitors are typically long-stay travellers, often staying between 10 and 14 days, and frequently returning annually. They often travel in multi-generational family units or multi-couple groups.

For property buyers, this behavior underpins steady demand for well-located two- and three-bedroom accommodation. Niseko property buyers have found that “Dual-Key” configurations—where a property can be split into two separate rental units—perform exceptionally well with this demographic, as they offer the flexibility to accommodate large groups or smaller independent parties.

Hong Kong and Singapore: The Premium Core

Hong Kong and Singapore remain consistent contributors at the premium end of the market. While total visitor numbers may be lower than Australia, spending levels and expectations are significantly higher. These visitors prioritize convenience, often seeking ski-in/ski-out access and high-end concierge services. Properties offering strong privacy and proximity to the lifts in Upper Hirafu or Hanazono tend to perform best with this audience.

The United States: A Rapidly Growing Segment

The United States has emerged as one of the fastest-growing winter markets in recent years. This growth is driven by a “perfect storm” of factors: improved awareness of Niseko’s legendary “Japow” snow quality, easier access via expanded flight paths into New Chitose Airport, and the inclusion of Niseko on global ski passes like the Ikon Pass and Epic Pass.

North American visitors often treat Niseko as a “bucket list” destination, staying for longer durations and showing a high preference for large, standalone private residences and luxury villas. This has bolstered the high-end segment of the Niseko real estate market.

Summer Source Markets: The “Green Season” Evolution

Summer in Niseko has developed more quietly, but with increasing importance for long-term owners and buyers focused on year-round usability.

International summer visitors are more heavily weighted toward regional Asia, including Hong Kong, Taiwan, and South Korea. These travellers are typically shorter-stay guests, often combining Niseko with other parts of Hokkaido. Their motivations differ from winter visitors; they are often escaping the extreme heat of mainland Asia to enjoy Hokkaido’s cooler climate, nature, food, and wellness offerings.

Investor Insight: The growth of Niseko summer tourism has broadened the appeal of properties beyond ski season performance. Homes and apartments with panoramic views of Mt. Yotei, outdoor terrace spaces, and proximity to walking trails or golf courses are increasingly relevant for capturing this growing summer rental demand.

The “Yen Factor” and Economic Resilience

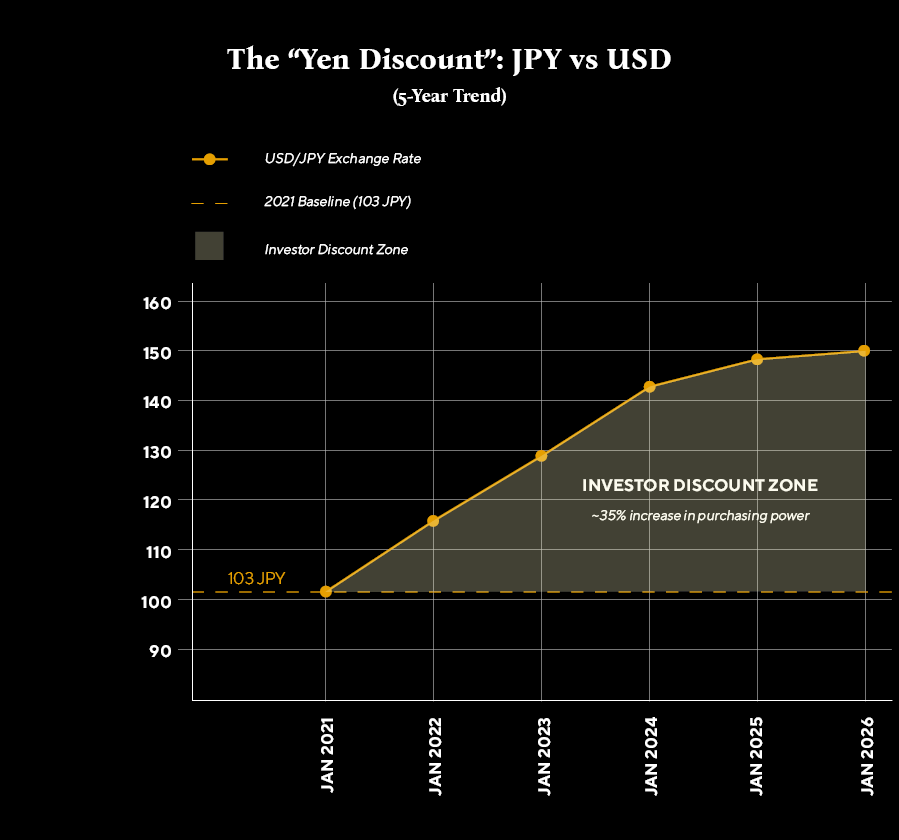

A critical factor for Niseko property buyers in 2025 and 2026 is the Japanese Yen. The prolonged weakness of the Yen against the USD, AUD, and HKD has effectively placed Niseko real estate “on sale” for international investors.

While property prices in Niseko have risen, the currency advantage often offsets these gains for offshore buyers. This has created a resilient market where cash-rich international investors are less sensitive to global interest rate fluctuations compared to other major alpine markets in Europe or North America.

Infrastructure and Future-Proofing

The long-term value of Niseko property is closely tied to ongoing infrastructure developments. Two major projects are currently reshaping the local landscape:

- The Hokkaido Shinkansen: The extension of the Bullet Train to Kutchan (targeted for completion around 2030-2035) will eventually link Niseko to Tokyo in roughly 4.5 hours. This is expected to significantly increase domestic Japanese tourism, particularly in the summer months.

- Luxury Brand Arrivals: The entry of world-class hospitality brands like Aman, Six Senses, and the Ritz-Carlton Reserve has professionalized the rental market. These developments attract a high-net-worth visitor profile that demands (and

Comparing Winter and Summer Property Needs

To maximize Niseko rental demand, buyers should understand the differing needs of these two peak seasons:

| Feature | Winter Visitor Priority | Summer Visitor Priority |

| Location | Ski-in/Ski-out or Lift proximity | Proximity to nature, golf, and dining |

| Space | Large dry rooms and ski storage | Outdoor decks and BBQ areas |

| Amenities | Fireplaces and indoor Onsens | High-efficiency Air Conditioning |

| Stay Type | Long-term (7–14 days) | Short-term (2–5 days) |

How Visitor Profiles Influence Property Demand

The way people visit Niseko matters just as much as how many arrive.

Winter visitors support stable weekly rental demand, making turnover efficiency less critical. However, summer stays are shorter, which favours properties within professionally managed buildings where cleaning, check-in, and guest services are streamlined and automated.

Group composition also plays a defining role. Niseko remains a group-oriented destination. Families and groups of friends drive demand for flexible layouts, multiple bathrooms, and living areas designed for shared use. This helps explain why well-configured mid-sized residences consistently outperform smaller, single-room formats in the resale market.

What Buyers Should Take From This Data

For property buyers, the key lesson is that demand in Niseko is shaped by behaviour, not just popularity.

Properties aligned with how visitors actually use the destination tend to perform more consistently across cycles. Ski access remains important, but it is rarely the only deciding factor. Privacy, storage, services, and year-round livability increasingly influence both rental outcomes and resale interest.

Equally important is avoiding assumptions based solely on peak-season volume. Niseko’s strength lies in repeat visitation, long stays, and a visitor base that often transitions from guest to owner over time. These fundamentals help explain why the market has remained comparatively stable through broader travel and economic cycles.

Summary: Why Visitor Trends Matter for Buyers

Niseko’s visitor profile today reflects a mature international destination. Winter demand remains strong and diversified, summer tourism continues to build steadily, and the characteristics of visitors align closely with the type of housing already favoured by the market.

For buyers, understanding these patterns supports better decisions around property selection, design, and long-term strategy, particularly for those seeking resilience rather than short-term gains.

Australia remains the largest international winter market, followed by Hong Kong and the United States. North American visitation has shown particularly strong growth due to the influence of the Ikon and Epic ski passes.

Yes. While summer stays are shorter, demand is increasingly reliable, especially for well-located properties with strong amenities (like AC and views) and professional management support that can handle higher guest turnover.

They do. Properties that reflect how people actually travel—specifically multi-bedroom layouts and homes with strong privacy—tend to attract broader buyer interest and hold their value better than small, inflexible units.

While the market has matured, capital gains are still achievable in “growth nodes” like Hanazono and Kutchan. However, most buyers in 2026 focus on a “yield plus lifestyle” model, using the property for personal use while benefiting from consistent rental income.

Yes. Japan allows foreigners to own freehold land and buildings. There are no restrictions on foreign ownership, which is a major factor in Niseko’s popularity compared to other Asian resort destinations where land ownership is often restricted to long-term leases.